“Inflation, indeed, throws a veil of illusion over every economic process. It confuses and deceives almost everyone, including even those who suffer by it.”

- Henry Hazlitt

Quick Hits

- Inflation continues to be a major headline as the market speculates on Fed interest rate policy.

- Shelter is moderating from high levels, while vehicle insurance is at an extreme statistically significant upside condition. Market narratives around inflation trends neglect to highlight disproportionate and unsustainable inflation in vehicle insurance.

- Statistical analysis helps identify when component contributions are meaningful or represent outliers.

- Simple allocations to equities have exceeded all expectations throughout this inflationary cycle.

- The inflation-disinflation tug-of-war will have significant impacts on financial markets and asset allocation.

- Inflation poses insidious risk to our future purchasing power. Our job as advisers is to help clients formulate a plan that drives the most critical decision in the pursuit of optimal real-life investment returns: the relationship between equity and fixed assets.

Introduction

Inflation refers to the rate of increase in the prices for goods and services, and most importantly to the erosion of purchasing power. In our view, the most fatal mistake an investor can make over the long term is under allocating to equities, the asset class which over history has demonstrated the highest potential to sustainably overcome inflation.

At the beginning of this year, we communicated our 2024 Inflation view within our organization:

The PAC inflation model indicates a shift from a clear signal when inflation was at extreme highs to a more normal level that indicates randomness and noise. Scenario analysis suggests a wide range of potential inflation outcomes for year-end, emphasizing the difficulty of accurate forecasting and the importance of focusing on establishing trend and direction of data. Inflation has moderated because spikes in inflation rolled off. This is exactly what we want! Positive inflation means that the economy is still growing. The data suggests to us that disinflationary trends may persist, but we should not expect the same levels of disinflation as we experienced last year.

Current Situation

Inflation came in at 3.4% YoY (year-over-year), down from 3.5% last month. Single reports carry little weight in our investment committee discussions, however, trend and direction matter most.

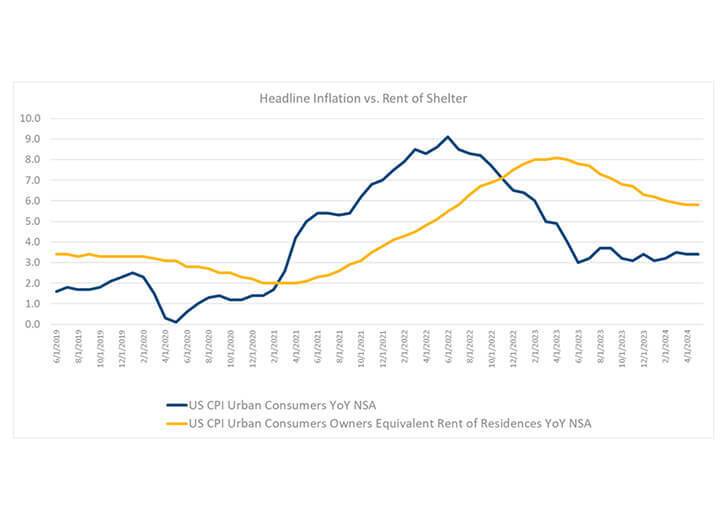

The greatest and most enduring contribution to inflation since the post-Covid supply chain crunch has been Rent of Shelter (which includes the often-referenced Owners Equivalent Rent). This component is trending lower, albeit very sluggishly. For this reason, and in the absence of unexpected future shocks, we do assign better than favorable odds that inflation will continue to trend lower.

Source: Bloomberg

How Statistical Analysis Can Help

In any reporting period, there are components exhibiting higher inflationary pressures, and some with deflationary pressures. Many strategists look for the pressures that conform to their macro call and highlight those components. Because ebbs and flows are normal, for example gasoline prices, we need to look beyond regular variations to determine whether any such components have statistical significance. There are two statistically significant drivers of inflation.

First, Rent of Shelter is up 5.6% YoY. The average up to 2021 was 3.2%. Rent of Shelter accounts for 36% of CPI.

Second, Motor Vehicle Insurance is up 22.6% YoY. While Motor Vehicle Insurance makes up less than 3% of the CPI Index, it contributed 0.66% to YoY inflation this month and 0.65% last month. In other words, this one very small component makes up 19% of the total inflation print.

To put this contribution into context, this YoY increase is a 4 standard deviation event! In a normal probability distribution, the probability of a four standard deviation event at one tail is 0.003%, or about 1 in 33,333.

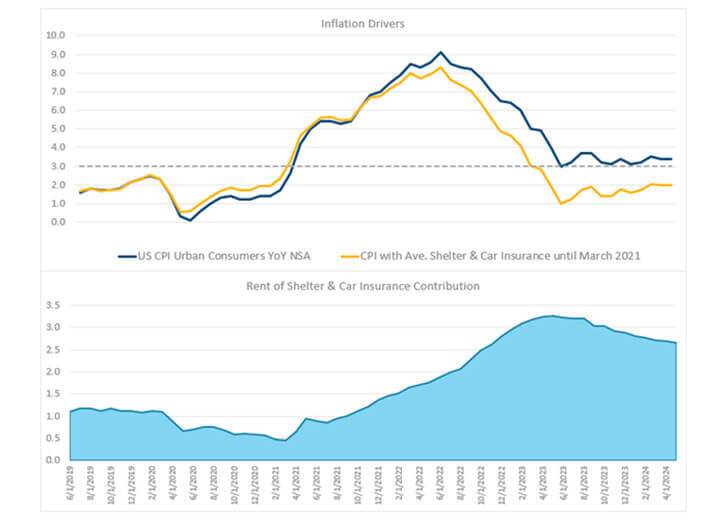

If we were to apply the averages up to 2021 of Rent of Shelter (3.2%) and Motor Vehicle Insurance (4.4%) to this report, CPI YoY would have been 2.0%, not 3.4% (Yellow line next graph). As the bottom clip in the next graph shows, the combined contribution of these two components peaked a year ago and has been moderating, albeit slowly, since.

Are any of us convinced vehicle insurance is sustainable at these levels? Where is this discussion in the market narratives!?

Source: Bloomberg and Park Avenue Capital

Long-Term View; Inflation Tug of War

The investing public is inundated with commentary and prognostication on what a single report “means”. Ultimately, we think the most important signal to watch is the tug of war between short to intermediate-term inflationary pressures vs. longer-term disinflationary trends.

We believe the long-term disinflation forces will end up exerting a strong influence over time, but we are prepared to change our views if necessary.

The inflation-disinflation tug of war will have significant impacts on financial markets and asset allocation. The following are a few high-level determinants of the future direction of inflation, one way or the other.

Major Conflicts, Inflationary. A combination of a lack of a major conflict and globalization exerted tremendous disinflationary pressures on the global economy from 1990 until recently. Major conflicts are inflationary, and a long war in Ukraine, and geopolitical strife that may escalate into armed conflict increase inflationary pressures.

When there are no major wars across the world, however, globalization and more open commerce tends to be deflationary. Not all rises in inflation are caused by war, but historically all major wars result in a spike in inflation.

Demographics, Disinflationary. Projected demographics are terrible in most large economies. According to Pew Research, by 2100 the world's population is projected to reach approximately 10.9 billion, with annual growth of less than 0.1%. Globally, 1 in 6 people will be over age 65 by 2050, compared with 1 in 11 last year, according to Bloomberg. China is facing an aging of the population and declining birth rates. South Korea now has the lowest birth rate in the world, and here at home birthrates continue to decline. These long-term demographic trends are very deflationary. Industry research suggests and often concludes that there is a meaningful relationship between population growth and inflation, and that declines in population growth may have a stronger association with lower inflation than increases in population have on higher inflation (Moodys, "Population Growth and Inflation" August 2017).

Technology, Disinflationary. Technology is deflationary because productivity enhancements are becoming embedded in almost everything we do, personal and professional. Just think about the power of our smartphones, tablets, automobiles, and many other daily applications we probably take for granted. We do not yet know the full potential of artificial intelligence (AI) but there appear to be signs that AI can help boost productivity.

No matter what the industry, companies are using technology to drive their business. We believe technology is the driver of economic growth across all industries and will continue to exert disinflationary pressures.

Geoeconomic Fragmentation, Inflationary. This term covers all the related concepts of deglobalization, reshoring, industrial policy, tariffs, and related terms. Global economies are shifting to self sufficient supply chains and engaging in economic competition and conflict through economic and trade policy, and there is a change of economic blocks separating into Western liberal values and autocratic ones. Greater investment in property, plant and equipment and higher transactions costs for goods and services are clearly very inflationary.

Conclusion

We maintain an unwavering belief the most important decision you can make in your financial lifetime is your allocation to equity vs fixed assets due to the long-term impacts of inflation. We look forward to discussing your planning and investment alignment in your next review.

The opinions expressed are those of Park Avenue Capital as of 07/10/2024 and are subject to change. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment. Diversification and strategic asset allocation do not assure profit or protect against loss.

This newsletter is provided for informational purposes only and should not be interpreted as financial or insurance advice. Please see your Financial Advisor or Representative for specific recommendations to meet your personal needs and objectives.